Understanding Closing Costs: What Buyers and Sellers Should Expect

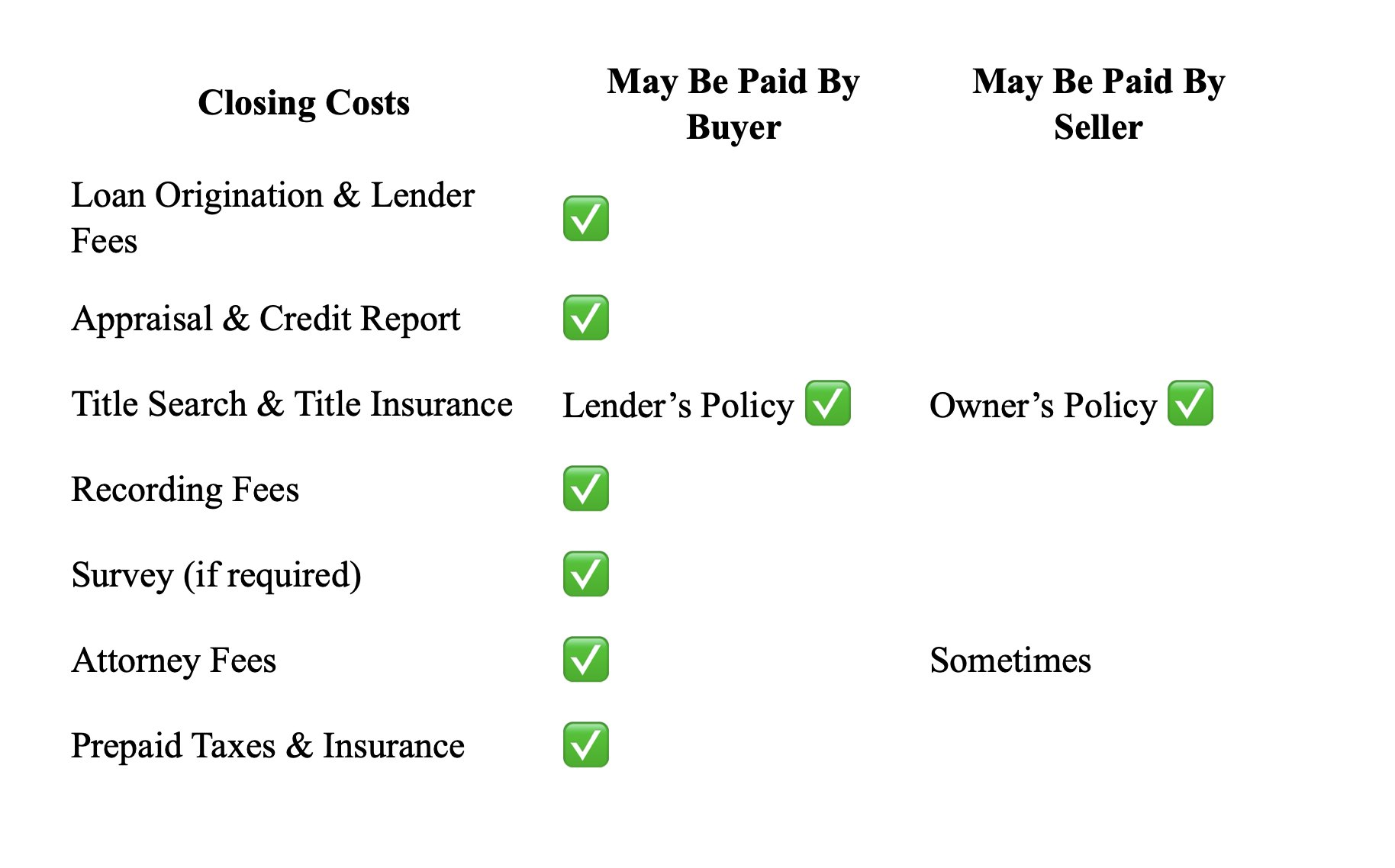

Closing costs are the fees and expenses that come with finalizing a real estate transaction. Who pays which costs depends on the contract terms, local custom, and negotiation between buyer and seller. Below is a general overview of common fees and how they’re typically handled, though each deal may differ.

Buyer’s Closing Costs

Loan Origination & Lender Fees – For processing the mortgage.

Appraisal & Credit Report – Required by the lender.

Title Search & Title Insurance (lender’s policy) – Protects the lender’s interest.

Recording Fees – To record the deed and mortgage with the county.

Survey Fee – If required.

Attorney Fees – Depending on the state or if chosen by the buyer.

Prepaid Items – Taxes, insurance, and prepaid interest.

Portion of Escrow/Settlement Fees – Shared or negotiated.

Real Estate Commissions – Compensation for agents is negotiable and determined in the listing/buyer agreements and purchase contract.

Seller’s Closing Costs

Real Estate Commissions – Compensation for agents is negotiable and determined in the listing/buyer agreements and purchase contract.

Title Search & Owner’s Title Insurance – In Ohio and many other states, sellers often provide the owner’s policy, but this can vary.

Transfer / Conveyance Tax –

Montgomery County Conveyance Fee: $3 per $1,000 of the sale price.

Conveyance Fee varies slightly based on the county.

Deed Preparation – Preparing and recording the deed.

Portion of Escrow/Settlement Fees – Shared or negotiated.

Prorated Property Taxes – Seller typically pays up to the day of closing.

HOA Resale/Transfer Fees – If applicable.

Buyer Credits / Concessions – If agreed upon in the contract.

Side-by-Side Comparison (General Overview)

✅ Key Takeaway: Closing costs vary by transaction. All fees are outlined in the closing disclosure from the title office.